Recent Presentation:

Overview of Global Stocks, Bonds, and Consumers Leading Indicators (SBCLI), September 2016

SBCLI 3rd Quarter 2016 Tables, Charts, and Commentary -- Asia Presentation, September 8th 2016

Asian Central Banks and University Talks on Central Bank Impacts, September 2016

Dynamic Hedging of Fixed Rate Mortgages, August 2016

SBCLI original paper:

A Stocks, Bonds, Consumers Leading Index (SBCLI paper)

Latest Research:

Consumer Signals (Jan.15 2016 version 4.5)

Consumption-Based Asset Pricing, Part 1: Classic Theory and Tests, Measurement Issues, and Limited Participation

Consumption-Based Asset Pricing, Part 2: Habit Formation, Conditional Risks, Long-Run Risks, and Rare Disasters

Consumption-Based Asset Pricing: Research and Applications

Central Bank Policy Impacts on the Distribution of Future Interest Rates

Work in progress, with Robert H.Litzenberger

Consumption As A Leading Indicator

1. "Breeden Yale Stocks Bonds Consumers Leading Indicator Commonfund Level II July 2012"

2. "Breeden Consumption As A Leading Indicator April 2012"

3. "Breeden SBCLI Applied Paper April 2012"

4. "Breeden MIT Shorter Talk Consumption As Leading Indicator April 2012"

5. "Breeden MIT Tokyo Shorter Presentation March 2012"

Behavioral Decision Making

"Breeden Commonfund Institute Yale Talk on Behavioral Decision Making July 12 2012"

SELECTED ACADEMIC PUBLICATIONS:

1. "Prices of State‑contingent Claims Implicit in Option Prices," (with Robert H. Litzenberger), Journal of Business 51, No. 4, pp. 621-651, October 1978. Reprinted in Options: Classic Approaches, Risk Books.

2. "An Intertemporal Asset Pricing Model with Stochastic Consumption and Investment Opportunities," Journal of Financial Economics 7, pp. 265-2966, September 1979. Reprinted in Theory of Valuation: Frontiers of Modern Financial Theory, pp. 53-84, Volume 1, (edited by S. Bhattacharya and G.Constantinides), Rowman and Littlefield press, 1989.

3. "Consumption Risk in Futures Markets," Journal of Finance, Proceedings issue,Volume 35, No. 2, pp. 503-520, May 1980.

4. "Futures Markets and Commodity Options: Hedging and Optimality in Incomplete Markets," Journal of Economic Theory, 32, No.2, pp. 275-300, April 1984.Reprinted as Chapter 1 in Frontiers of Finance, pp. 7-32, Deborah H. Miller and Stewart C. Myers (ed.), Basil Blackwell, Ltd, 1990.

5. "Consumption, Production, Inflation and Interest Rates: A Synthesis," Journal of Financial Economics, 16, May 1986, pp. 3-39. (lead article).

6. "Intertemporal Portfolio Theory and Asset Pricing," in The New Palgrave: A Dictionary for Economics, MacMillan Press (London), 1987.

7. "An Introduction to Hedging Interest Rate Risks with Futures, Swaps and Options," (with Michael G. Giarla), in The Handbook of Mortgage-Backed Securities, pp. 889-986, Frank J. Fabozzi (editor), 3rd edition, Probus Publishing (Chicago), 1991; 2nd edition, 1987. Reprinted in Asset / Liability Management, pp.237-328, Frank J. Fabozzi and Atsuo Konishi (ed.), Probus Publishing Company, 1991.

8. "Bank Risk Management," in The Handbook of Modern Finance, chapter 34, pp. 1-55, Dennis Logue (ed.), Warren, Gorham and Lamont, 1989.

9. “Empirical Tests of the Consumption-Oriented CAPM," (with Michael R. Gibbons and Robert H. Litzenberger), Journal of Finance, June 1989, pp. 231-262. (lead article). Reprinted in Empirical Research in Capital Markets, pp. 413-444, G. William Schwert and Clifford W. Smith (ed.), McGraw-Hill, Inc., 1992. McGraw-Hill, Inc., 1992.

10. "Risk, Return, and Hedging of Fixed Rate Mortgages," Journal of Fixed Income, September 1991, pp. 85-107. Reprinted in The Handbook of Mortgage-Backed Securities, pp. 783-826, Frank J. Fabozzi (ed.), Probus Publishing Company, 1995.

11. "Strategies for Profitable Lending in the 1990s: The New Basics," in The Secondary Mortgage Market, pp. 473-491, Jess Lederman (ed.), Probus Publishing Company, 1992. Reprinted in The Secondary Mortgage Market, pp.473-492, Jess Lederman (ed.), Probus Publishing Company, 1992.

12. "Complexities of Hedging Mortgages" Journal of Fixed Income, December, 1994, pp. 6-41. (lead article).

13. "Pricing Bank Assets and Liabilities: A Path-Dependent Approach," (with James H. Gilkeson), Journal of Banking and Finance, June 1997.

14. "Convexity and Empirical Option Costs of Mortgage Securities," Journal of Fixed Income, March, 1997, pp. 64-87. Reprinted in Interest Rate Risk Measurement and Management, pp. 343-376, Sanjay K. Nawalkha and Donald R. Chambers (ed.), Institutional Investor, Inc., 1999.

15. “Optimal Dynamic Trading Strategies,” Economic Notes, Vol. 33, pp. 55-81, 2004.

16. “The Use and Misuse of Models in Investment Management,” CFA Institute Conference Proceedings Quarterly,” December 2009.

17. (with Robert H. Litzenberger and Tingyan Jia), “Consumption-Based Asset Pricing, Part 1: Classic Theory and Tests, Measurement Issues and Limited Participation,” Annual Reviews of Financial Economics, December 2015 (lead article).

18. (with Robert H. Litzenberger and Tingyan Jia), “Consumption-Based Asset Pricing, Part 2: Habit Formation, Conditional Risks, Long-Run Risks, and Rare Disasters” Annual Reviews of Financial Economics, December 2015.

19. (with S. “Vish” Viswanathan) "Why Do Firms Hedge? An Asymmetric Information Model", Journal of Fixed Income, Winter 2016 (lead article).

20. “Consumer Signals,”in the Journal of Asset Management, July 2016.

SELECTED WORKING PAPERS AND NOTES

- “A Stocks, Bonds, Consumers Leading Indicator: Consumer Behavior As A Leading Indicator,” working paper, Duke University, September 2010.

- "Why Do Firms Hedge? An Asymmetric Information Model", (with S. Viswanathan), Working paper, Duke University, 1999.

- “Corporate Bonds and Banking” Lecture presented at the Berkeley Program in Finance, La Jolla, California, March, 1999.

- "Consumption and Market Risks of Corporate Cash Flows", Working paper, Duke University, September 1991.

- “Capital Budgeting with Consumption,” Working paper, Duke University, Fuqua School of Business. Presented at the French Finance Association in June 1989.

PUBLISHED NOTES AND COMMENTS

- "Equilibrium Term Structure Models: Discussion", Journal of Finance, May 1980.

Overview of Global Stocks, Bonds, and Consumers Leading Indicators (SBCLI), September 2016

SBCLI 3rd Quarter 2016 Tables, Charts, and Commentary -- Asia Presentation, September 8th 2016

Asian Central Banks and University Talks on Central Bank Impacts, September 2016

Dynamic Hedging of Fixed Rate Mortgages, August 2016

SBCLI original paper:

A Stocks, Bonds, Consumers Leading Index (SBCLI paper)

Latest Research:

Consumer Signals (Jan.15 2016 version 4.5)

Consumption-Based Asset Pricing, Part 1: Classic Theory and Tests, Measurement Issues, and Limited Participation

Consumption-Based Asset Pricing, Part 2: Habit Formation, Conditional Risks, Long-Run Risks, and Rare Disasters

Consumption-Based Asset Pricing: Research and Applications

Central Bank Policy Impacts on the Distribution of Future Interest Rates

Work in progress, with Robert H.Litzenberger

Consumption As A Leading Indicator

1. "Breeden Yale Stocks Bonds Consumers Leading Indicator Commonfund Level II July 2012"

2. "Breeden Consumption As A Leading Indicator April 2012"

3. "Breeden SBCLI Applied Paper April 2012"

4. "Breeden MIT Shorter Talk Consumption As Leading Indicator April 2012"

5. "Breeden MIT Tokyo Shorter Presentation March 2012"

Behavioral Decision Making

"Breeden Commonfund Institute Yale Talk on Behavioral Decision Making July 12 2012"

SELECTED ACADEMIC PUBLICATIONS:

1. "Prices of State‑contingent Claims Implicit in Option Prices," (with Robert H. Litzenberger), Journal of Business 51, No. 4, pp. 621-651, October 1978. Reprinted in Options: Classic Approaches, Risk Books.

2. "An Intertemporal Asset Pricing Model with Stochastic Consumption and Investment Opportunities," Journal of Financial Economics 7, pp. 265-2966, September 1979. Reprinted in Theory of Valuation: Frontiers of Modern Financial Theory, pp. 53-84, Volume 1, (edited by S. Bhattacharya and G.Constantinides), Rowman and Littlefield press, 1989.

3. "Consumption Risk in Futures Markets," Journal of Finance, Proceedings issue,Volume 35, No. 2, pp. 503-520, May 1980.

4. "Futures Markets and Commodity Options: Hedging and Optimality in Incomplete Markets," Journal of Economic Theory, 32, No.2, pp. 275-300, April 1984.Reprinted as Chapter 1 in Frontiers of Finance, pp. 7-32, Deborah H. Miller and Stewart C. Myers (ed.), Basil Blackwell, Ltd, 1990.

5. "Consumption, Production, Inflation and Interest Rates: A Synthesis," Journal of Financial Economics, 16, May 1986, pp. 3-39. (lead article).

6. "Intertemporal Portfolio Theory and Asset Pricing," in The New Palgrave: A Dictionary for Economics, MacMillan Press (London), 1987.

7. "An Introduction to Hedging Interest Rate Risks with Futures, Swaps and Options," (with Michael G. Giarla), in The Handbook of Mortgage-Backed Securities, pp. 889-986, Frank J. Fabozzi (editor), 3rd edition, Probus Publishing (Chicago), 1991; 2nd edition, 1987. Reprinted in Asset / Liability Management, pp.237-328, Frank J. Fabozzi and Atsuo Konishi (ed.), Probus Publishing Company, 1991.

8. "Bank Risk Management," in The Handbook of Modern Finance, chapter 34, pp. 1-55, Dennis Logue (ed.), Warren, Gorham and Lamont, 1989.

9. “Empirical Tests of the Consumption-Oriented CAPM," (with Michael R. Gibbons and Robert H. Litzenberger), Journal of Finance, June 1989, pp. 231-262. (lead article). Reprinted in Empirical Research in Capital Markets, pp. 413-444, G. William Schwert and Clifford W. Smith (ed.), McGraw-Hill, Inc., 1992. McGraw-Hill, Inc., 1992.

10. "Risk, Return, and Hedging of Fixed Rate Mortgages," Journal of Fixed Income, September 1991, pp. 85-107. Reprinted in The Handbook of Mortgage-Backed Securities, pp. 783-826, Frank J. Fabozzi (ed.), Probus Publishing Company, 1995.

11. "Strategies for Profitable Lending in the 1990s: The New Basics," in The Secondary Mortgage Market, pp. 473-491, Jess Lederman (ed.), Probus Publishing Company, 1992. Reprinted in The Secondary Mortgage Market, pp.473-492, Jess Lederman (ed.), Probus Publishing Company, 1992.

12. "Complexities of Hedging Mortgages" Journal of Fixed Income, December, 1994, pp. 6-41. (lead article).

13. "Pricing Bank Assets and Liabilities: A Path-Dependent Approach," (with James H. Gilkeson), Journal of Banking and Finance, June 1997.

14. "Convexity and Empirical Option Costs of Mortgage Securities," Journal of Fixed Income, March, 1997, pp. 64-87. Reprinted in Interest Rate Risk Measurement and Management, pp. 343-376, Sanjay K. Nawalkha and Donald R. Chambers (ed.), Institutional Investor, Inc., 1999.

15. “Optimal Dynamic Trading Strategies,” Economic Notes, Vol. 33, pp. 55-81, 2004.

16. “The Use and Misuse of Models in Investment Management,” CFA Institute Conference Proceedings Quarterly,” December 2009.

17. (with Robert H. Litzenberger and Tingyan Jia), “Consumption-Based Asset Pricing, Part 1: Classic Theory and Tests, Measurement Issues and Limited Participation,” Annual Reviews of Financial Economics, December 2015 (lead article).

18. (with Robert H. Litzenberger and Tingyan Jia), “Consumption-Based Asset Pricing, Part 2: Habit Formation, Conditional Risks, Long-Run Risks, and Rare Disasters” Annual Reviews of Financial Economics, December 2015.

19. (with S. “Vish” Viswanathan) "Why Do Firms Hedge? An Asymmetric Information Model", Journal of Fixed Income, Winter 2016 (lead article).

20. “Consumer Signals,”in the Journal of Asset Management, July 2016.

SELECTED WORKING PAPERS AND NOTES

- “A Stocks, Bonds, Consumers Leading Indicator: Consumer Behavior As A Leading Indicator,” working paper, Duke University, September 2010.

- "Why Do Firms Hedge? An Asymmetric Information Model", (with S. Viswanathan), Working paper, Duke University, 1999.

- “Corporate Bonds and Banking” Lecture presented at the Berkeley Program in Finance, La Jolla, California, March, 1999.

- "Consumption and Market Risks of Corporate Cash Flows", Working paper, Duke University, September 1991.

- “Capital Budgeting with Consumption,” Working paper, Duke University, Fuqua School of Business. Presented at the French Finance Association in June 1989.

PUBLISHED NOTES AND COMMENTS

- "Equilibrium Term Structure Models: Discussion", Journal of Finance, May 1980.

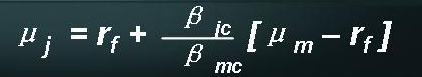

Consumption Capital Asset Pricing Model